Barry Ritholtz, who is president of a money manager in New York and writes a blog called “The Big Picture,” has an interesting comment today about using the covers of major magazines as indicators of how to invest.

Ritholtz notes that there are 56 covers of major magazines with Apple’s Steve Jobs on the front. Writes Ritholtz, “So the key question for afficianados of the magazine cover indicator is simply this: Which cover was your sell signal?

“The collage above shows why the cover indicator is not really applicable to single companies . . . ”

Ritholtz argues that the magazine cover indicator is more applicable for trends, such as the stock market, or the boom in industries like the Internet or nano-technology. He states, “In my experience, the Cover Indicator is useful for determining when large social phenomena are reaching an emotional crescendo. Oftentimes, emotions take over at the extremes, as things become either giddy or bleak.”

I’ve got to agree with him. Business magazines are notoriously bad when it comes to predicting trends, especially in the stock market. I recently came across a stock chart from Ned Davis Research that superimposed famous magazine covers with the Dow Jones Industrial Average.

I’ve got to agree with him. Business magazines are notoriously bad when it comes to predicting trends, especially in the stock market. I recently came across a stock chart from Ned Davis Research that superimposed famous magazine covers with the Dow Jones Industrial Average.

To give you a sample of how bad the predictions have been, here are a few examples:

1. BusinessWeek’s Nov. 2, 1968 cover called “The Boom that Just Won’t Stop” came out when the Dow was at 975. By the middle of 1970, the Dow was at 660.

2. The Barron’s dated Jan. 8, 1973 had the headline “1,200 on the Dow” when the index was at 1020. By the end of 1974, the Dow had dropped to below 600.

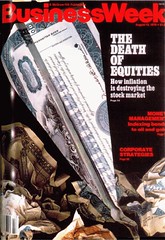

3. Then there is BusinessWeek’s infamous Aug. 13, 1979 cover called “The Death of Equities,” which came out when the Dow was at about 800. We all know what happened to the Dow in the next two decades.

4. The Fortune magazine dated Oct. 26, 1987 had the headline “Why Greenspan is bullish” and came out just days before the crash that lopped 25 percent off the market in one day.

4. The Fortune magazine dated Oct. 26, 1987 had the headline “Why Greenspan is bullish” and came out just days before the crash that lopped 25 percent off the market in one day.

5. After the crash, U.S. News & World Report’s Nov. 9, 1987 cover was titled “How to Ride out the Bull Market.” The Dow was at 2,000, and would rise to 11,000 in the next 14 years.

6. BusinessWeek’s Dec. 24, 1990 cover title was “The New Face of Recession.” The country was about to enter the longest time period of economic prosperity it has ever seen.

The point here is that the business media have been incredibly bad in predicting the economy and the stock market. There are lots of investors out there who look at covers such as these and do the opposite with their money.

OLD Media Moves

Magazine covers as investment tools

March 20, 2006

Barry Ritholtz, who is president of a money manager in New York and writes a blog called “The Big Picture,” has an interesting comment today about using the covers of major magazines as indicators of how to invest.

Ritholtz notes that there are 56 covers of major magazines with Apple’s Steve Jobs on the front. Writes Ritholtz, “So the key question for afficianados of the magazine cover indicator is simply this: Which cover was your sell signal?

“The collage above shows why the cover indicator is not really applicable to single companies . . . ”

Ritholtz argues that the magazine cover indicator is more applicable for trends, such as the stock market, or the boom in industries like the Internet or nano-technology. He states, “In my experience, the Cover Indicator is useful for determining when large social phenomena are reaching an emotional crescendo. Oftentimes, emotions take over at the extremes, as things become either giddy or bleak.”

To give you a sample of how bad the predictions have been, here are a few examples:

1. BusinessWeek’s Nov. 2, 1968 cover called “The Boom that Just Won’t Stop” came out when the Dow was at 975. By the middle of 1970, the Dow was at 660.

2. The Barron’s dated Jan. 8, 1973 had the headline “1,200 on the Dow” when the index was at 1020. By the end of 1974, the Dow had dropped to below 600.

3. Then there is BusinessWeek’s infamous Aug. 13, 1979 cover called “The Death of Equities,” which came out when the Dow was at about 800. We all know what happened to the Dow in the next two decades.

5. After the crash, U.S. News & World Report’s Nov. 9, 1987 cover was titled “How to Ride out the Bull Market.” The Dow was at 2,000, and would rise to 11,000 in the next 14 years.

6. BusinessWeek’s Dec. 24, 1990 cover title was “The New Face of Recession.” The country was about to enter the longest time period of economic prosperity it has ever seen.

The point here is that the business media have been incredibly bad in predicting the economy and the stock market. There are lots of investors out there who look at covers such as these and do the opposite with their money.

Highlighted News

Qwoted 100 PR Superstar: Amanda Kruse of UpSpring

April 23, 2024

Media News

Parker promoted to ME of economy/government coverage at Bloomberg

April 23, 2024

Media News

Bloomberg’s Cortez moving to Washington

April 23, 2024

Media News

Heatmap News hires Brigham to cover climate tech

April 23, 2024

Full-Time

Houston Chronicle seeks a reporter to cover politics and the economy

April 23, 2024

Subscribe to TBN

Receive updates about new stories in the industry daily or weekly.