Yahoo Inc. reported earnings Tuesday that beat analyst expectations but its revenue came in below estimates as the company attempted to soothe the worries of its acquirer Verizon Communications.

Yahoo Inc. reported earnings Tuesday that beat analyst expectations but its revenue came in below estimates as the company attempted to soothe the worries of its acquirer Verizon Communications.

Kara Swisher of Recode had the news:

Analysts had expected the company to report earnings of 14 cents per share, excluding certain expenses, compared to 15 cents in the same period a year ago. Instead, Yahoo reported earnings of 20 cents.

Wow, right? Well, no. While it looks like a big beat, this result is primarily due to cost cuts and not massive growth in its businesses. Adjusted Ebitda, which is a real measure of performance, was down to $229.2 million from $244.2 million. (Kudos to CFO Ken Goldman for making it look better than it is at Yahoo via cost cuts and creative accounting!)

While revenue in its mobile, video and native businesses rose, the big moneymakers declined as advertisers fled and traffic declined. Display ad revenue was down 7 percent and search revenue was down 14 percent.

Revenue was expected to rise to $1.3 billion, which is close to 7 percent higher than last year, except when payments to partners is added in. Then it was expected to fall to $862 million, a 14 percent decline. Instead, it was even lower at $857.7 million.

Tracey Lien of the Los Angeles Times notes that Yahoo declined to give any specifics about its recent hack or the Verizon deal:

It was Yahoo’s first reporting period since Verizon agreed to buy the beleaguered Sunnyvale, Calif., company. It was the first since it dropped the bombshell that it got hacked in 2014 in a breach that compromised 500 million user accounts — an attack that may have a “material” impact on Verizon’s $4.8 billion offer.

On both the breach and the sale, Yahoo remained tight-lipped, forgoing its usual live webcast with analysts — presumably to dodge thorny questions. After the close of markets, Yahoo instead issued its report and a statement from Chief Executive Marissa Mayer, who said the company is “busy preparing for integration with Verizon,” and it remains “very confident, not only in the value of our business, but also in the value Yahoo products bring to our users’ lives.”

The company’s silence doesn’t come as a surprise, according to Forrester Research analyst Fatemeh Khatibloo, because Yahoo is likely under constraints as to what it can say.

“It would have been an hour of ‘Sorry, no comment,’ which probably would have been more frustrating,” Khatibloo said.

Matthew Lynley of TechCrunch reported that Yahoo’s numbers show the hack didn’t affect its business:

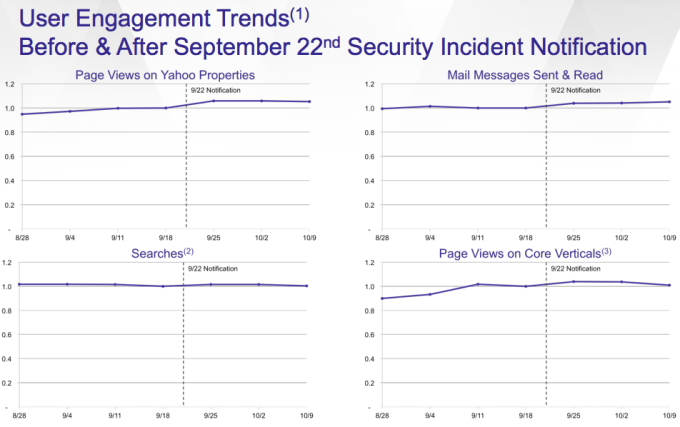

Yahoo even seems to be trying to get ahead of the issue by literally publishing engagement charts following the reports (each with a wildly ambiguous y-axis, natch). It seems like the company is trying to show that people still continued to use its services without a hitch after the stories hit:

For Wall Street, the value of Yahoo for the past years has instead been locked up in its stake in Alibaba. Jerry Yang made one of the most ambitions — and wildly successful — bets in the technology world when he invested $1 billion in the budding e-commerce company in China. That resulted in a massive windfall that would be worth orders of magnitude more than Yahoo’s own core business. To that extend, a lot of the executive leadership’s team’s role has been managing the ultimate fate of that cash pile.

Much of the blame for the lack of a turnaround has fallen on Mayer. Looked upon as the Googler who would find a way to bring the company back to growth and profitability, Mayer was named CEO of the company in July 2012. Since then, the company has rapidly whiplashed to multiple different strategies such as focusing on building mobile apps and large content plays, but didn’t find anything that would really stick and attract new users.